Microfinancing the Microfinancing Partners in Africa Way

Microfinancing Partners in Africa collaborates with grassroots organizations to support and amplify their microfinancing efforts. Despite having different approaches to extend a helping hand to people, our partners share several common elements that we consider as best practices or “Microfinancing the Microfinancing Partners in Africa Way.”

- Lifting up people in extreme poverty

- Operating as a nonprofit (proceeds are folded in to reach more people)

- Embracing “first you must save”, valuing savings as well as small loans

- Open to anyone regardless of religion, race, tribe, ethnicity

- Providing ongoing training and support to ensure success

- Having accountability for loan repayments or pay-it-forward commitments

- Each of these projects is sustainable with or without Microfinancing Partners in Africa’s involvement

The differentiator is sustainability

Microfinancing Partners in Africa understands that a person’s exclusion from a role in the production of a marketable product impoverishes the person. An empty wallet or pocket is merely a symptom of this exclusion. A gift of cash may temporarily relieve the symptom, but it will not cure the condition. Participation in the production of valued goods and services is the cure for persistent poverty.

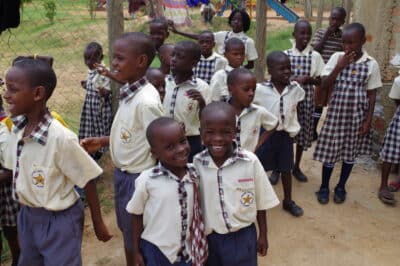

We focus on helping people build businesses from scratch because of the extreme poverty of the surrounding communities.

- When there are few businesses offering jobs, we help people create businesses.

- When there are no local lenders, we assist with loans.

- Where there is no business experience, we help with education and coaching.

- When the consequences of poverty, such as illness or alcoholism, threaten to undermine the young entrepreneur, we look for mitigating solutions.

MPA, in partnership with like-minded African organizations, works to help people in poverty begin businesses and, despite the endemic obstacles, succeed.

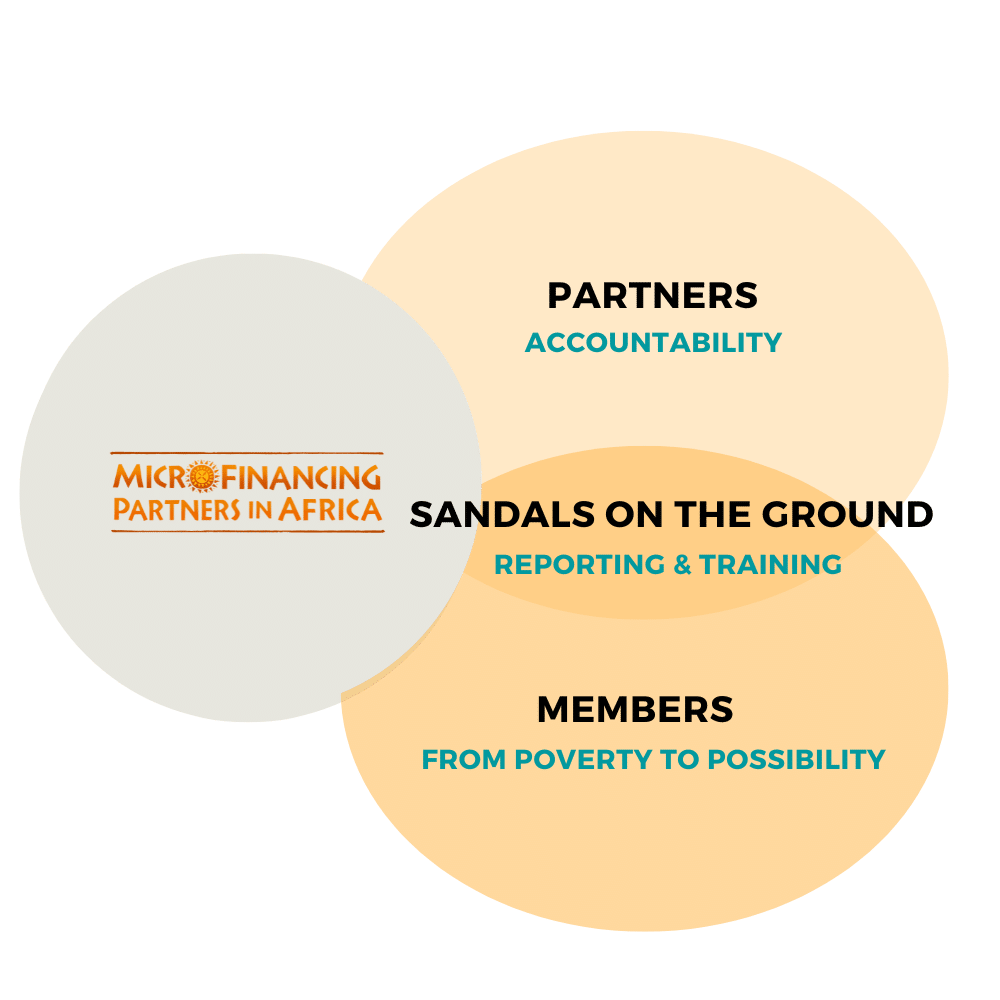

Our collaboration structure

Collaboration between many individuals provides a structured approach to achieving our common goals – alleviating extreme poverty.

What We Do

More About Our Programs

How do we define success in achieving sustainability?

At least 80% of group members:

- Have ability to pay for school fees

- Have savings account with 3+ months of expenses

- Have an income over $60USD / month

Each group member has:

- At least 2 meals a day

- Access to clean water

- Protein at 1 meal a day

- Separate sleeping areas for children and parents

The group is sustainable when:

- Group has enough assets produced to provide loans for current membership

- All members meet the improved standard of living and financial stability criteria

The link between poverty & health

“Poverty is a major cause of ill health and a barrier to accessing health care when needed. This relationship is financial: the poor cannot afford to purchase those things that are needed for good health, including sufficient quantities of quality food and health care.”

– The World Bank: Poverty & Health Brief, 202

Why are loans better than a hand out?

A hand out

- Paid rent for 6 months

- Got the family temporarily off the street

- No steady stream of income

- Children’s school fees still unpaid

- Lack of food security

- No education or training

- Funds depleted after one use

A hand up

- Provided training on savings and starting businesses

- Invested in Leo to open his own business

- Created a sustainable source of income that provides improved food security

- Enabled Leo’s family to build and own their own house

- Allowed Leo to provide children’s ongoing school fees

- Empowered the group to lend the money again after Leo repaid his loan