I remember visiting Jane in her home in Mathare Slum in Nairobi, Kenya. Jane’s home was assembled of various sheets of rusty corrugated metal, leaning against each other. She had doilies and pieces of material draped wherever there was a place to attach them. The floor was dirt—as much compacted trash as actual earth—but was covered in a few reed mats. The door was another piece of metal with one hinge. We navigated around the sharp edges and entered. Jane greeted us and offered tea as she balanced her grandchild on her lap.

Jane shared that she was one of the 50 original women who, 20 years ago, started Jamii Bora with Ingrid Munro. Jane’s income project was “hawking” CDs to drivers as they were stopped in gridlocked traffic on Juja Road. What a difficult job that must be—to convince busy commuters to purchase a non-necessity in the middle of traffic. Jane shrugged and explained that joining Jamii Bora had indeed lifted her up. The other mothers encouraged her to begin saving, and she was able to take her first loan in the amount of two times what she had in savings.

I felt discouraged. Twenty years of saving, investing in an income project, repaying a loan, and doing it again and again and again, and Jane was still living in the slum. I asked her, “What has changed for you?” What Jane shared next shattered my lens for evaluating success, pierced my heart, and changed my life.

She said, “Thanks to our small savings program, I have built my business and I have saved. I still live here in Mathare, because that is where I was born, and because I choose to. I choose to do this because I have spent my savings in getting my children educated.”

I was impressed, “Wow! How old are they? What year are they in school?” Jane replied, “My four children are in university.”

Jane had earned and saved enough, thanks to microfinancing, to leave Mathare slum and build a nice home in a nice neighborhood. She chose to spend her money on something much more valuable: her children’s education.

I learned then that the outward evidence of success is not always the material things in front of you. Success is so much more.

I learned then the power of the math of microfinancing as well, and this is at the heart of how Jane could be so successful even when starting with so little.

Jane’s savings group emphasizes saving. You can borrow twice what you save. You have specific loan terms (how long to repay and a fixed interest rate), and weekly meetings with your group to troubleshoot any problems while they are small. Everyone in the group is invested in each other’s success.

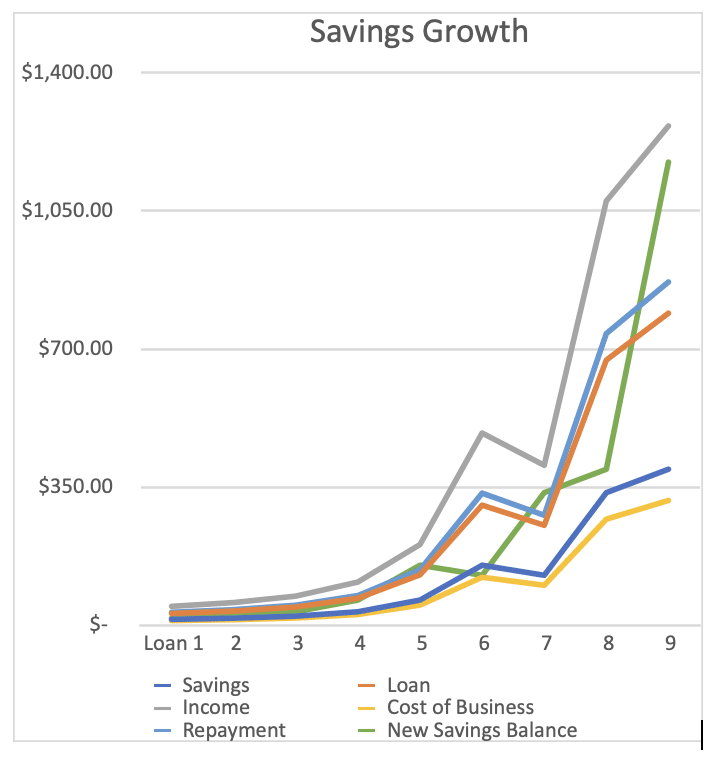

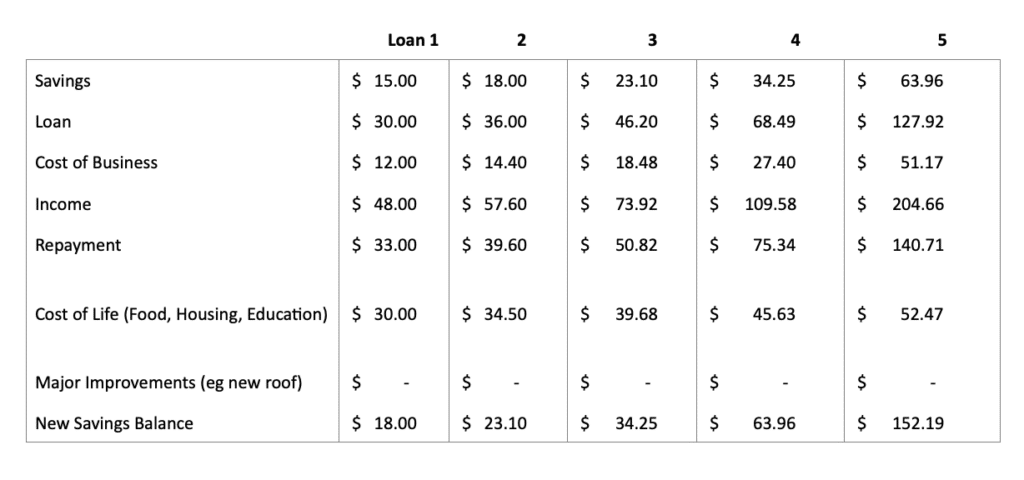

So here is a bit of math to illustrate.

If Jane had started her first loan at the point that she had accumulated $15.00 in savings, she would be able to borrow $30.00. With that, Jane spends $12.00 on CDs to sell. She sees income of $48.00, repays her loan at $33.00, and spends some on monthly life expenses of $30. This leaves her with $18.00 in savings.

Continuing for a few more cycles shows how Jane’s savings can grow:

(these monetary figures are hypothetical and not an accurate reflection of Jane’s exact income/ profit.)

The trend is clear. Microfinancing can be a powerful vehicle not only for generating income but for building savings—wealth. Jane used her wealth to fund education for her children. I can’t imagine a more successful businesswoman.